For Homeowners To Gain Control of Their Financial Situation

CONSOLIDATE DEBT AND RECEIVE YOUR 48 HOUR DEBT RESET PLAN

✔️ one payment, ✔️ lower‑interest options, ✔️ credit‑safe pre‑check.

Homeowners.. Clean Up Holiday Debt Before 2026

Claim Your Free Debt Reset Plan

Speak With Our Debt Consolidation Experts and See Exactly How Fast You Could Be Debt Free

1

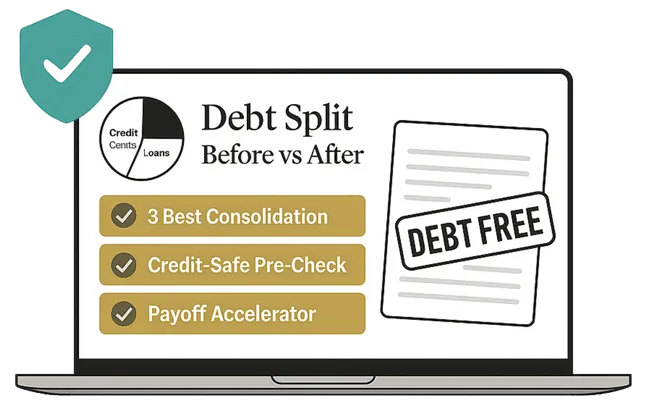

3 Best Consolidation Options (side‑by‑side repayments, total interest, fees)

2

Credit‑Safe Pre‑Check (serviceability review before any hard pull)

3

Payoff Accelerator (no‑extend plan + automatic extra repayments)

4

Re‑Accumulate Shield (card closure guidance, spending freeze, autopays)

5

Bank/Creditor Negotiation Pack (scripts for rate cuts, fee waivers, hardship)

Recent Homeowner Wins Helping Aussies Just Like You

"Rolled 4 debts into our mortgage → Saved $923/mo"

QLD homeowner, 3 cards + ATO rolled into mortgage.

"Thought arrears would kill it. They pre-checked serviceability and added debts into a new refinance."

$1,290 scattered → one mortgage payment $367 extra.

- H.S

"From 19.9% cards → 5.5% mortgage rate"

NSW couple with $28k on cards.

"We were paying 19.9%+ and couldn’t keep up. Sue refinanced into our mortgage at 5.5%."

11 days later, all cards were closed. One lower repayment, no more juggling.

-P.D

"Behind on Repayments, still refinanced!"

WA Tradie, 2 months behind on loans.

"Expected a no, but instead Sue showed how arrears can still be rolled into a new mortgage."

All debts cleared into one simple loan, no more creditors calling me.

- O.G

"ATO rolled into mortgage, I feel relieved"

SA sole trader, ATO + card + loan.

"I felt embarrassed owing to the tax office. They calmly showed 3 refinance options. We got everything consolidated and fixed"

$418/mo saved; my accountant’s relieved too.

-S.S

"Saved by Know Howe"

NSW homeowner, bruised credit.

"They said if rolling debts into the mortgage wouldn't help, they'd tell me. We passed serviceability, refinanced, and closed 5 accounts."

No need to avoid calls from creditors anymore, thanks so much Sue.

- K.S

“Refinanced but didn’t add 30 years”

VIC family with personal + car loans.

"I didn’t want a 30-year extension. They refinanced into the mortgage but set up a No-Extend Payoff schedule."

We keep paying extra

automatically, finishing years earlier at a lower interest.

- M.D

Apply for Your Free Debt Reset Plan Today, and Discover Exactly How Much You Could Lower Your Repayments and Reduce Interest Rates.

✔ 15-Minute Triage Call

A quick, no-pressure chat to understand your debt, cash flow, and goals

✔ Docs + Credit-Safe Pre-Check

We review your position without a hard enquiry, so your credit score stays protected.

✔ 48-Hour Plan Delivery

You’ll receive a written plan with 3 tailored options, side-by-side repayments, and a clear payoff schedule.

✔ Done-For-You Implementation

If you’re ready, we handle everything, negotiations, paperwork, and setup, so you make one simple payment

We created the Reset Plan because most Aussies with debt get stuck in guesswork and fear of rejection. Banks rarely explain your real options, and going in blind can damage your credit or lock you into the wrong deal. It’s designed to get you out of “panic mode” and back into control, in days, not months.

Every Day You Wait, You’re Bleeding Profits and Losing Deals

You’ve found the perfect site.

The numbers stack up.

But then—the funding stalls.

Banks drown you in red tape, private lenders slap on sky-high interest rates, and your project? Dead in the water.

Each delay sends costs spiralling—holding expenses, rising interest rates, and supplier prices creeping up by the day.

The longer you wait, the thinner your margins get, turning a once-profitable project into a financial headache.

Deadlines loom, budgets blow out, and suddenly you're scrambling to plug gaps just to keep things afloat.

While you’re battling delays, your competitors are closing deals, breaking ground, and cashing in.

The sites you scouted? Gone.

The profits you planned for? In someone else’s pocket.

Months of planning, negotiations, and site analysis? Wasted, all because the funding didn’t come through.

But it doesn’t have to be this way.

Hi, I’m Michael, Director at Balcombe Financial.

We help property developers secure the funding they need to acquire, build, and complete high-return developments—without the usual financial roadblocks.

Whether you’re working on a small subdivision, a large-scale apartment complex, or a commercial development, we tailor solutions that move your projects forward fast and with maximum flexibility.

With access to over 40+ bank, non-bank, and private lending solutions, we unlock flexible terms, maximise your loan amounts, and keep your projects moving from acquisition to completion.

“Michael found me a loan that others said wasn't possible”

- John Zambelis, Victoria

“Michael’s professional services were key in securing the finance on our commercial development in a tight timeframe”

- Casey Landman, Victoria

No more missed deadlines. No more compromises.

Just streamlined, stress-free financing that lets you scale your portfolio, maximise your profits, and build long-term wealth.

Ready to secure the capital you need—fast and stress-free?

Apply for your free 'Get Funded' Consultation with Victoria’s top property development finance experts.

We’ll never leave it up to algorithms or call centre staff to future growth of your projects.

In this complimentary 20-minute session, we’ll help you:

1

GET A FINANCING STRUCTURE BUILT FOR YOUR PROJECT:

Discover the exact funding solution for your development goals—no more ‘one-size fits all’ loans that don’t fit your needs.

2

SECURE FAST APPROVALS WITHOUT THE USUAL ROADBLOCKS: We’ll map out how to cut through lender red tape and get your project moving—before delays eat into your profits.

3

FUND YOUR PROJECT WITH LESS OF YOUR MONEY: We’ll show you how to secure financing with minimal personal capital and more lender flexibility than you thought possible.

4

WALK AWAY WITH A CLEAR, ACTIONABLE FUNDING STRATEGY: Get a clear, actionable financing strategy tailored to your development—no fluff, no wasted time, just the exact next steps to get funded fast.

Spots are limited, and projects are moving fast.

Don’t let another opportunity slip through your fingers— apply for your free ‘Get Funded’ Strategy Session today and secure the financing you need before it’s too late.

To your success,

Completely free to explore.

No strings attached.

How Smart Developers

Get Funded

[Baseline Feature – Industry Standard]

[Baseline Feature – Industry Standard]

[Baseline Feature – Industry Standard]

[Hidden Cost or Downsides of Competitors]

[Customer Support/Service]

B

Comparison #1

Comparison #1

100% Free, No-Obligations

Got Questions?

We’ve Got the Answers

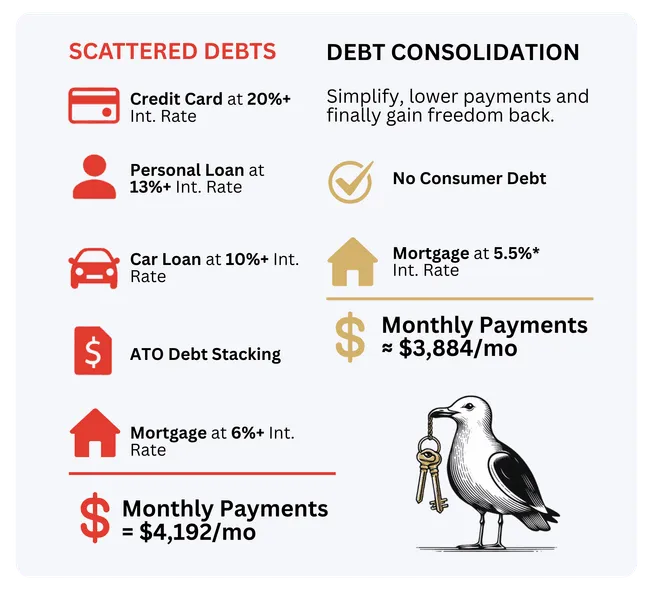

What is debt consolidation?

Debt consolidation means putting all your loans, like credit cards and personal loans, into one big loan. That way, you only make one payment each month, and it can save you money if the new loan has a lower interest rate.

Why would someone want to combine their debts?

Having many loans can be confusing. When you put them together into one loan, it’s easier to manage. You can pay less in interest and feel more in control of your money.

Can anyone get a debt consolidation loan?

Not always. Lenders look at things like your job, how much money you make, and if you pay bills on time. If you’ve had money troubles, you might still get help through a special lender.

What types of debt can be added to a home loan?

You can combine things like credit card debt, personal loans, car loans, or even AfterPay bills. The goal is to make one easier payment instead of many.

Is debt consolidation always the best idea?

It depends on your situation. It can help save money and make life easier. But if you keep spending too much, it could make things worse. Talking to a mortgage expert can help you decide.

Will combining my debts help my credit score?

Yes, it can! When you pay off your smaller debts and just have one loan, it shows you’re managing your money better. Over time, this can make your credit score go up, as long as you keep making your payments on time.

Our Service Will Help Decrease Burning Problem By Quantifiable Measure Or Penalty

We’re so confident in our ability to [Achieve Outcome] that we’re taking all the risk off your shoulders.

If we don’t [Specific Result Guarantee], you won’t pay a cent. No fine print, no hidden conditions – just a rock-solid guarantee to prove how committed we are to your success.

Because at [Your Business Name], we don’t just promise results. We guarantee them. If we don’t deliver, you don’t pay. It’s that simple.

100% Free, No-Obligations

Still Not Sure About Something?

Your 1st Frequently Asked Question Goes Here?

Your response here gives the answer and shows the benefit of choosing you over any and every competitor out there.

Your 2nd Frequently Asked Question Goes Here?

Your response here gives the answer and shows the benefit of choosing you over any and every competitor out there.

Your 3rd Frequently Asked Question Goes Here?

Your response here gives the answer and shows the benefit of choosing you over any and every competitor out there.

Your 4th Frequently Asked Question Goes Here?

Your response here gives the answer and shows the benefit of choosing you over any and every competitor out there.

Your 5th Frequently Asked Question Goes Here?

Your response here gives the answer and shows the benefit of choosing you over any and every competitor out there.

100% Free, No-Obligations

Spots Are Filling Fast...

Claim Your Free Offer Name Today and Benefit

100% Free, No-Obligations

General information only; not tailored to your circumstances. Comparison rates available on request. Credit criteria, fees and charges apply. Approval is not guaranteed. We are licensed under CRN: 000570974 | ACN: 681 111 035 Knowe Howe’s 48-Hour Debt Reset applies only once all required documents and resources are provided. Timing is subject to lender policies, valuations, and discharge processes.